There wasn’t a lot of movement in the CPI outside of gasoline prices last month, as evidenced by the all-items excluding gasoline calculation, which dropped marginally from 2.5% in July to 2.4% in August. Notably, shelter inflation—the largest component of the CPI basket—fell to 2.6%, its lowest level since March 2021.

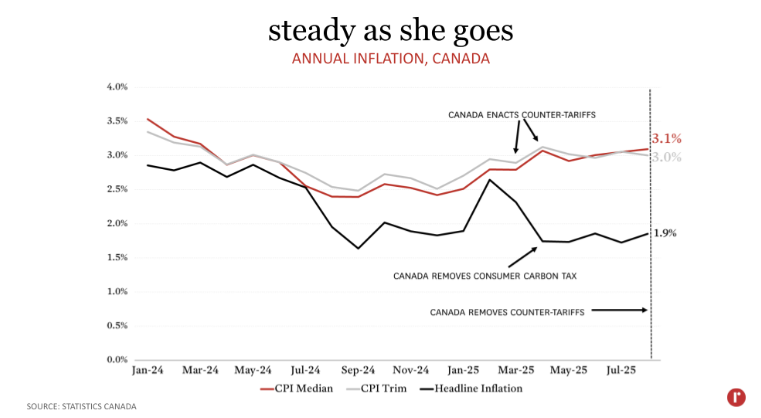

Core measures of inflation, which have been elevated, were also steady in August. CPI Median remained unchanged last month at 3.1%, while CPI Trim dropped to 3.0% from 3.1% in July. These measures both rose above 3% in April, and have remained elevated ever since.

It appears that growth in core measures of inflation has moderated in recent months, as evidenced by the 6-month annualized calculations (2.8% for both CPI Trim & Median) and the 3-month annualized calculations (2.6% for CPI Median & 2.4% for CPI Trim). One contributor to rising prices in April was likely Canada’s implementation of counter-tariffs on the United States in March and April, which were otherwise masked by falling energy prices. Prices for some goods that were tariffed rose on a month-to-month basis in April, including household appliances (+1.2%), household tools (+0.7%), and audio equipment (+0.7%). Canada has since (as of September 1st) removed all counter-tariffs for CUSMA-compliant goods with the exception of steel, aluminum, and autos. To the extent that the counter-tariffs had put upward pressure on prices here in Canada, there is potential for price reductions in the next release of the CPI as counter-tariffs are lifted.

The August CPI data show that inflation remains in check, though it is aided by removal of the consumer carbon tax. Meanwhile, the economy is showing weakness in other areas. The labour market has shed jobs in each of the past two months, while Q2 GDP was negative as exports to the US dropped sharply and business investment stagnated. The Bank of Canada will almost certainly cut its policy rate by 25 basis points at its next rate announcement (on September 17th). After that, the Bank has two more interest rate announcements remaining in 2025 (October 29th and December 10th) and there is a strong likelihood that the Governing Council will cut at least one more time.

The August CPI data show that inflation remains in check, though it is aided by removal of the consumer carbon tax. Meanwhile, the economy is showing weakness in other areas. The labour market has shed jobs in each of the past two months, while Q2 GDP was negative as exports to the US dropped sharply and business investment stagnated. The Bank of Canada will almost certainly cut its policy rate by 25 basis points at its next rate announcement (on September 17th). After that, the Bank has two more interest rate announcements remaining in 2025 (October 29th and December 10th) and there is a strong likelihood that the Governing Council will cut at least one more time.