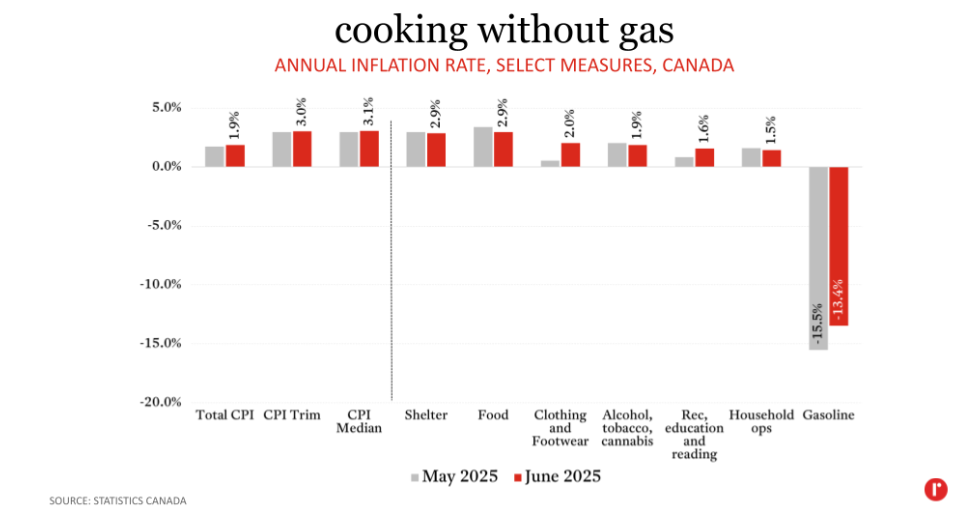

Shelter inflation slowed further in June, and fell to its lowest level in more than four years. Food, household operations, and alcoholic beverages, tobacco products and recreational cannabis categories likewise all saw their annual inflation rate decline in June. Notably, clothing and footwear, which relies heavily on international trade, saw its inflation rate increase last month, as did recreation, education, and reading, which includes some goods from the United States on which Canada has placed counter-tariffs (like sports equipment and audio visual equipment).

The Bank of Canada’s preferred measures of core inflation, CPI Trim and CPI Median, were both once again at or above 3% in June. That both measures remain somewhat elevated will be of concern to the Bank of Canada. Moreover, with inflation just below target and a labour market that most recently added 83,000 jobs, the Bank has more than enough reason to hold its policy rate at 2.75% on July 30th. Canada and the US are currently engaged in trade negotiations with an August 1st deadline for potential implementation of new tariffs. The Bank will likely wait to assess the results of the talks and assess the impacts of any new tariff rates before deciding what course of action to take in the fall.